What is a Blockchain

A Reaction to Broken Systems

In 2007, the world was rocked by a global financial crisis triggered by irresponsible lending behavior from centralized banks. People lost homes, savings, and trust. That crisis birthed a quiet revolution. In online forums, a small group of cryptography and digital money enthusiasts debated how to build a better system. One that was transparent, decentralized, and global. One of those chat group members went by the name, Satoshi Nakamoto.

From that conversation came the foundation for blockchain technology—and shortly after, Bitcoin. But what is blockchain technology?

Moore’s Law made it possible

The same year, something else was happening. Moore’s Law—the idea that computer chips double in power and halve in size roughly every 18 months—had reached a tipping point. The result? Computers became fast, cheap, and ubiquitous. That made way for groundbreaking technologies like the iPhone, Facebook, and Airbnb.

It also made blockchain possible. A decentralized network like Bitcoin requires thousands of nodes (computers) to verify and store data. Without high-speed, low-cost computing, this would have been impossible.

So, what IS a Blockchain?

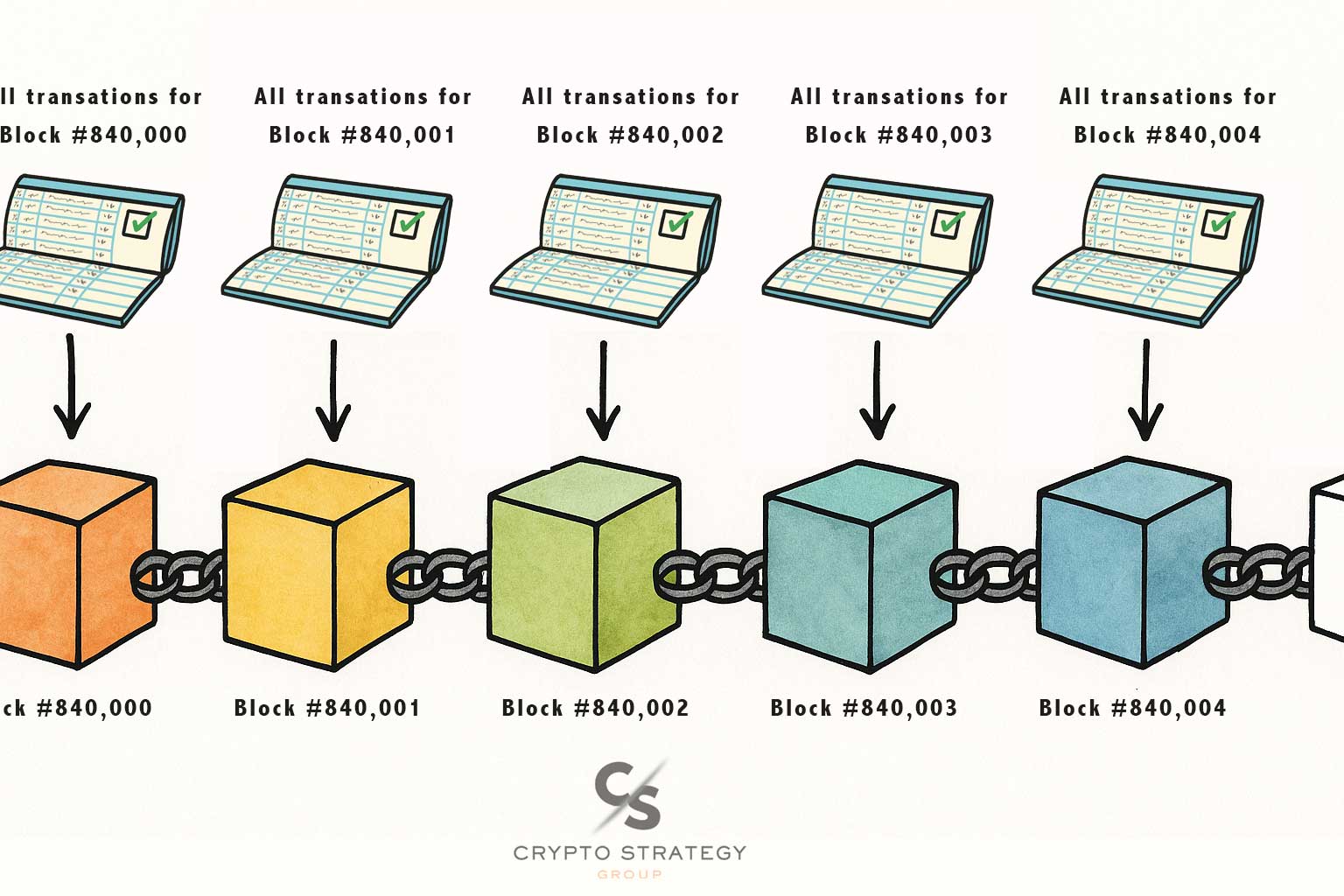

Imagine one big public global checkbook register that anyone can see. Every entry—every transaction—is etched into this digital ledger in order. Once a transaction (tx) is written, it cannot be erased or changed. This checkbook is public, permanent, and transparent.

Each “block” is like a filled page of that checkbook. Once a block is full, it’s permanently added to the chain, and a new block begins. Over time, this creates a verifiable timeline of transactions: a chain of blocks—hence the name.

And blockchains are designed to be decentralized. There’s no master server where blockchain data is stored, but rather a blockchain’s existence is spread across thousands of servers that all have the same exact version of the current blockchain at all times. If one server goes down, the blockchain is unaffected.

Decentralization is a key selling point to blockchain technology. Whereas the 2007 global financial crisis was caused by centralized banking power, blockchain is designed to not be influenced by anyone. It’s truly for the people by the people. No one runs it. There’s no corporate headquarters or CEO.

Blockchains and all the transactions recorded on chain will exist long after we’re gone. In fact, Bitcoin will keep generating new blocks until 2132 at which point the last block will ever be created. Everything ever added to the Bitcoin blockchain will be sorted, accessible and permanent.

You can view these transactions yourself. Each blockchain has its own explorer (aka checkbook register):

-

Bitcoin: mempool.space

-

Ethereum: etherscan.io

-

Solana: solscan.io

See the Bitcoin blocks being created in real time in the mempool. Most blocks take about 10 minutes to be created:

Why Blockchain Matters for Business

Blockchain introduces something every business craves: trust without intermediaries. It allows businesses owners to build trust in a trustless environment.

Here’s what blockchain technology brings to the table:

-

Immutability: Once a transaction is added, it can never be altered.

-

Proof of Ownership: From deeds to IP rights, ownership can be cryptographically verified.

-

Transparency: All parties can see the same truth. No hidden edits, no backdoors.

-

Security: Distributed networks are harder to hack than centralized databases.

-

Automation via Smart Contracts: Agreements execute automatically when conditions are met.

-

Access Control: Tokens can act as digital keys to exclusive experiences or communities.

- DeFi Opportunities: With decentralized systems like Bitcoin, Ethereum, Solana, etc.. there are no centralized banks to control the flow of money. Instead, you get to be the bank. Decentralized Finance tools (DeFi) make it possible to do what banks do—loan money and earn fees.

Real World Example: Imagine your business owns land in another country. One day the local government disputes your deed. If your ownership is recorded on blockchain, you have irrefutable proof that cannot be lost or forged.

Another example: digital art. If your brand collects or licenses digital works, blockchain can guarantee authenticity and provenance. That NFT tied to the art? It shows who created it, who owned it, and when.

A Look at the Major Blockchains

Bitcoin: The Original

Launched in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin was the first successful blockchain. It’s digital gold: a secure store of value in a decentralized format. Bitcoin doesn’t rely on a central authority—the network verifies itself. A new block is created roughly every 10 minutes.

Only recently have developers figured out how to build on Bitcoin using technologies like Ordinals (for NFTs) and Runes (for tokens).

Ethereum: Smart Contract Pioneer

Where Bitcoin offered decentralized money, Ethereum introduced decentralized software. It added smart contracts—self-executing agreements coded directly onto the blockchain. Two parties agree to terms; once both sign (typically with a digital wallet), the contract is automatically executed and stored forever.

Ethereum also kicked off the NFT boom, with projects like CryptoPunks granting owners access to exclusive Discords or private events.

Solana: Speed and Scale

Solana took the Ethereum playbook and made it faster and cheaper. It uses a unique mechanism called Proof of History, enabling blazing-fast transactions and minimal fees. This makes it ideal for real-time consumer apps, gaming, and micropayments.

Other Chains

Dozens of newer blockchains have emerged, each with specific features: privacy, scalability, identity management, interoperability, and more. These ecosystems offer a rich landscape for innovation.

Blockchain Is the Infrastructure of Web3

If the internet is the highway system, blockchain is the new digital infrastructure being built on top.

In Web2 (the age of social media), the focus was building personal profiles. But that data was harvested and monetized by big tech platforms. In Web3, you are defined by your wallet address, not your name or face.

Transactions look like this:

Wallet bc343i85…7t4 just bought 0.25 Bitcoin

No name. No profile. Just anonymous, verifiable action.

Blockchain and Provenance

“Provenance” refers to the origin of something valuable. Blockchain excels here. Who minted the first token? Who first owned a particular digital asset? These things matter. In art, commerce, and even supply chains, the ability to prove who did what and when is a powerful tool.

For example, if your company creates a limited-run product, that item’s history can be stored on-chain. Future customers can verify it’s the original.

Gated Access and Digital Communities

Blockchains also act as gates to private access. Want to get into a members-only club, private Discord, or VIP event? Ownership of a specific token or NFT can be your digital key.

Example: Holders of over 6.5 billion BONK tokens may be invited to exclusive investor channels.

Summary: Why Blockchain Is Good for Business

Blockchain is more than a buzzword. It’s a tool to:

-

Reduce fraud

-

Cut out middlemen

-

Streamline contracts

-

Prove ownership

-

Protect IP

-

Create gated customer experiences

-

Offer transparent supply chains

Whether you’re a winery proving terroir, a luxury brand issuing digital twins, or a consultancy protecting IP agreements—blockchain gives your business a new level of clarity and confidence.

Explore how your business can integrate blockchain. Contact us to start building your crypto strategy today.