Stablecoins like USDC are more than just a crypto payment option—they’re becoming a critical tool for reinforcing the U.S. Dollar’s dominance in the digital age. For businesses, accepting USDC is one of the key benefits of accepting USDC for businesses, as it isn’t just about tapping into new markets; it’s about participating in a macroeconomic shift that amplifies America’s financial influence worldwide.

Let’s break down how this works, with actionable insights for forward-thinking merchants.

🌎 1. USDC Expands Global Dollar Demand

Think of USDC as a digital passport for the U.S. Dollar. Every token represents $1 backed by cash or U.S. Treasuries, but its real power lies in how it’s used:

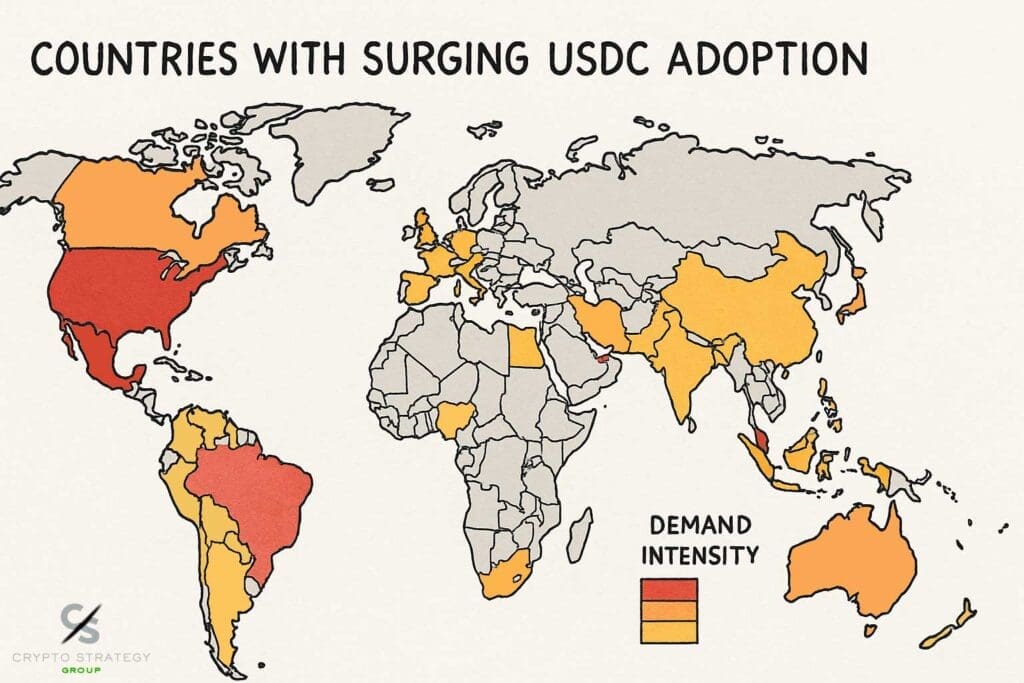

• Inflation Hedge for Emerging Markets: In countries like Argentina, Nigeria, and Venezuela, USDC offers a lifeline. Locals use it to preserve savings and transact globally without physical dollars or U.S. bank accounts. This creates new demand channels for the dollar, much like Eurodollars did decades ago.

• Network Effect: The more USDC circulates, the more businesses and individuals “opt in” to the dollar system. Over 70% of stablecoins are USD-pegged, making the dollar the default currency of crypto commerce.

⚖️ 2. Boosts U.S. Treasuries & “Exorbitant Privilege”

Every USDC token in circulation drives demand for U.S. government debt:

• USDC’s 1:1 backing means more cash and Treasuries are held in reserve.

• This strengthens the U.S.’s ability to borrow cheaply (the “exorbitant privilege”), as global demand for safe assets grows.

For context: If USDC’s market cap grows to $500 billion (from ~$30B today), it could offset foreign central banks reducing Treasury holdings.

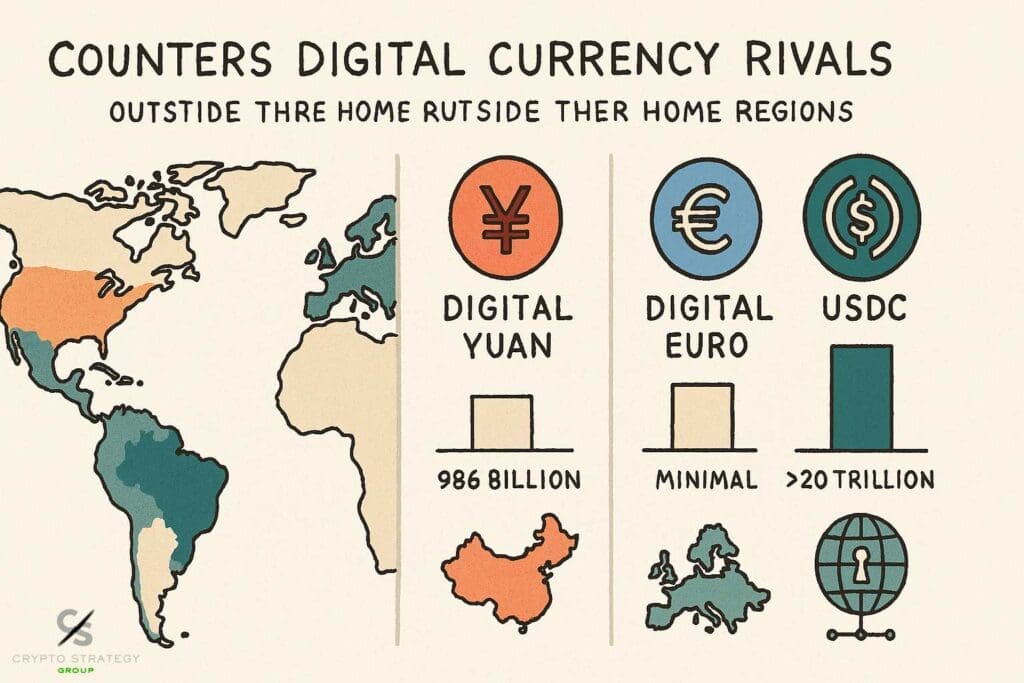

✨ 3. Counters Digital Currency Rivals

The U.S. Dollar’s dominance faces challenges:

• China’s digital yuan and the EU’s digital euro aim to reshape global finance.

• USDC counters this by embedding the dollar into decentralized ecosystems (DeFi, Web3) where rivals can’t easily compete.

Key Advantage: USDC operates permissionlessly—no SWIFT or bank accounts needed. A farmer in Kenya can accept USDC payments as easily as a New York business, keeping the dollar central to cross-border trade.

🤝 4. Empowers U.S. Businesses with Strategic Benefits

Accepting USDC isn’t just about crypto—it’s about aligning with macro trends:

• Lower Fees: Save 1-3% compared to credit cards.

• Faster Settlements: Transactions clear in seconds, not days.

• Global Reach: Access customers in 190+ countries holding digital dollars.

Deeper Impact: By adopting USDC, businesses reinforce the dollar’s role in digital commerce. Imagine a coffee shop’s POS system accepting USDC—it’s a small step for the merchant, but a leap for dollar ubiquity.

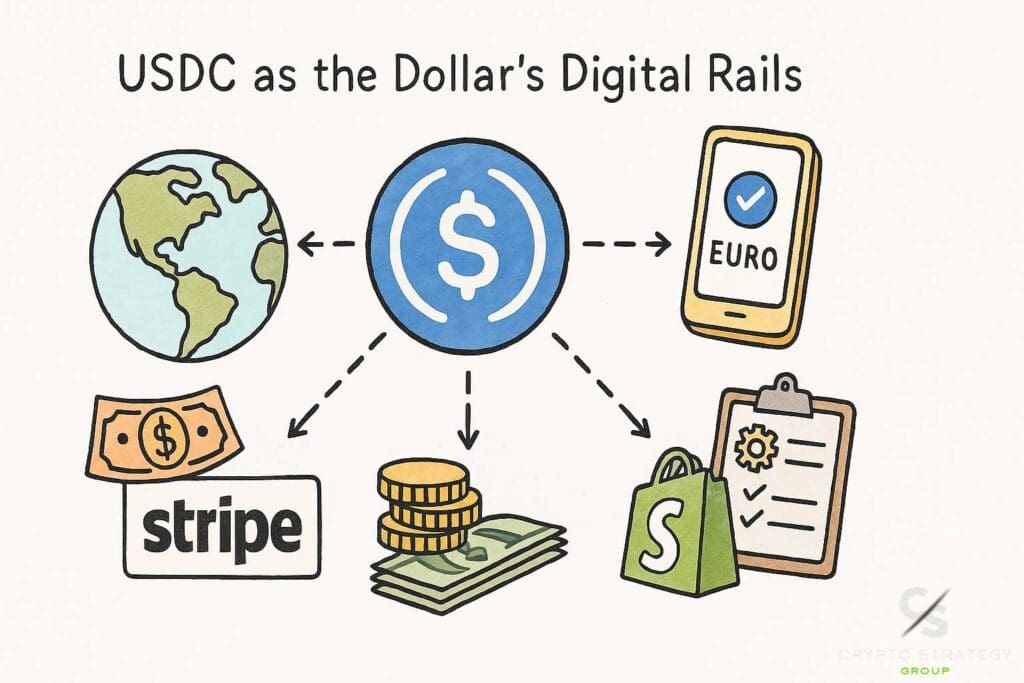

🚄 5. USDC as the Dollar’s Digital Rails

USDC isn’t just a currency—it’s infrastructure:

• Instant Remittances: Migrant workers send funds home cheaper and faster.

• DeFi Integration: Businesses can earn yield on USDC reserves or use it as collateral for loans.

• Programmable Money: Automate payroll, subscriptions, or cross-border invoices with smart contracts.

This turns the dollar into a tool for innovation, not just a static asset.

🔄 TL;DR: How USDC Strengthens the Dollar

📈 Why This Matters for Your Business

Every time you accept USDC, you’re not just streamlining payments—you’re contributing to a system that:

• Lowers U.S. borrowing costs

• Counters rival digital currencies

• Expands dollar access for billions globally

Final Thought: In the race for digital currency dominance, USDC is the dollar’s strongest ally. By adopting it, your business gains a competitive edge while supporting America’s economic leadership.

Ready to future-proof your business with USDC?

Book a free strategy session with Crypto Strategy Group to learn how to integrate crypto payments seamlessly.