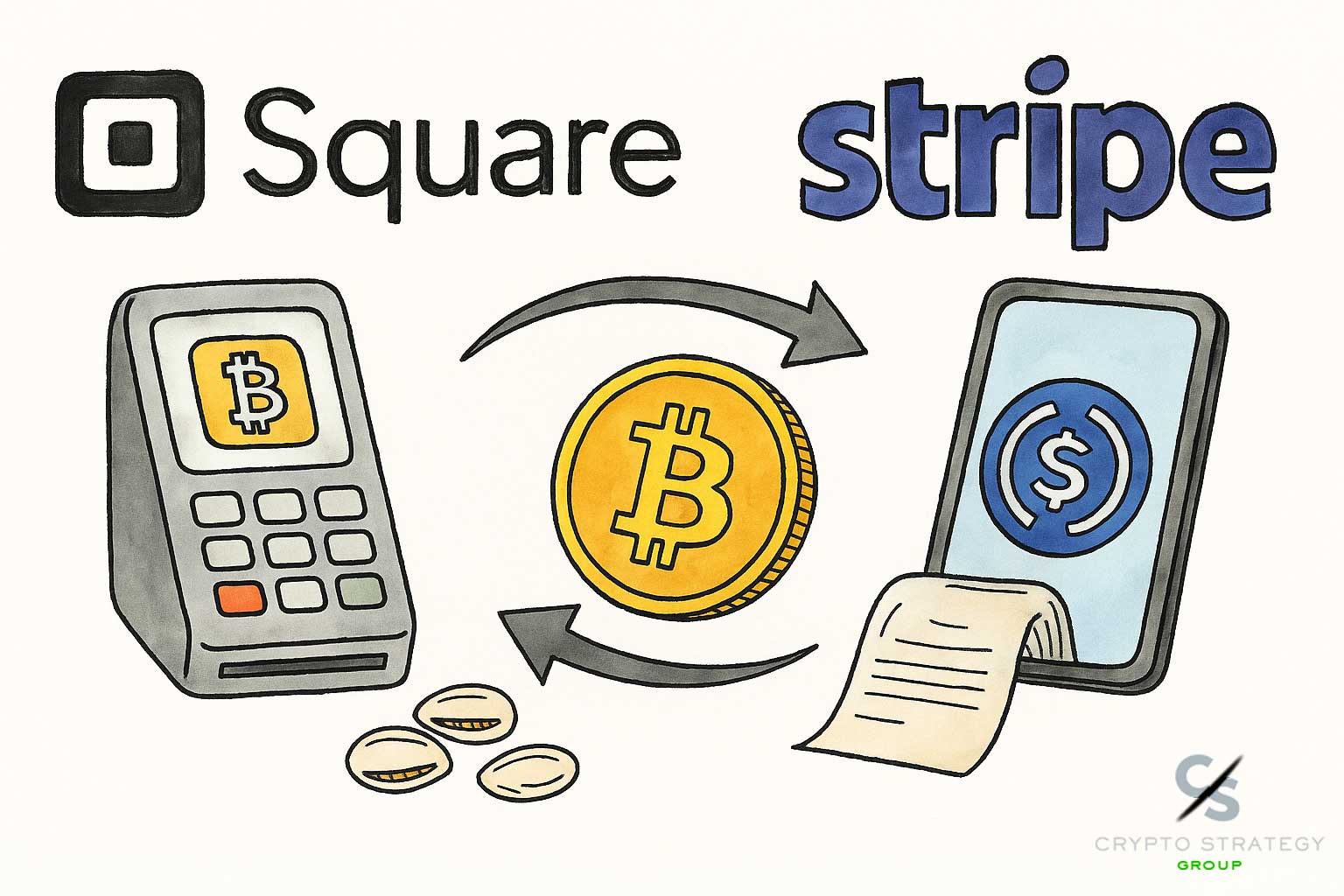

Major point-of-sale (POS) platforms such as Stripe and Square are making it easier for businesses to accept cryptocurrency by embedding crypto payment options directly into their existing systems. The implementations of Stripe and Square crypto integration are transforming how transactions are processed. Here’s how these integrations work in practical terms:

Stripe: Embedded Crypto Payments and Stablecoin Support

• Checkout Integration: Stripe allows businesses to add crypto payment options to their checkout flow, letting customers pay with cryptocurrencies like USDC (a stablecoin pegged to the US dollar) on networks such as Ethereum, Solana, and Polygon. When a customer selects crypto at checkout, they’re redirected to a secure page to connect their wallet and complete the payment.

• Instant Conversion to Fiat: For business owners, Stripe instantly converts crypto payments into US dollars (or your local currency) and deposits the funds into your Stripe account. This means you don’t have to manage wallets or worry about crypto price swings—the process feels just like accepting a credit card payment.

• No Technical Overhead: Businesses don’t need to handle crypto wallets, conversions, or compliance. Stripe manages fraud prevention, regulatory checks (like KYC), and disputes, making crypto payments through Stripe and Square crypto integration as seamless as traditional methods.

• Fiat-to-Crypto Onramp: Stripe also offers an onramp feature, allowing users to purchase cryptocurrency directly from your website or app using fiat money, with Stripe handling compliance and security.

Square: Native Bitcoin Payments via the Lightning Network

• Direct Bitcoin Acceptance: Square is rolling out the ability for merchants to accept Bitcoin payments directly through its POS hardware. Customers pay by scanning a QR code, and the transaction is processed using the Bitcoin Lightning Network, which enables near-instant and low-cost payments.

• Flexible Settlement: Merchants can choose to either keep the Bitcoin they receive or have it automatically converted to fiat currency in real time. This flexibility helps businesses manage crypto’s price volatility according to their comfort level.

• Seamless Experience: The integration is designed to be as easy as accepting any other payment method—customers simply scan a QR code, and Square handles the technical details behind the scenes, including real-time exchange rates and instant confirmation notifications.

• Expanded Features: Square’s new Bitcoin For Businesses feature builds on its existing Bitcoin Conversions tool, which already allows merchants to convert a portion of their daily sales into Bitcoin. The new rollout will make it possible for any eligible Square seller to accept Bitcoin payments natively by 2026 through Stripe and Square crypto integration.

Everyday Analogy

Think of these integrations like adding a new payment button to your register—whether it’s “Pay with Card,” “Pay with Apple Pay,” or now, “Pay with Crypto.” For the business owner, the process is designed to be as familiar and hassle-free as possible, with the platform handling all the crypto-specific complexities behind the scenes.

Key Takeaways for Business Owners

• No steep learning curve: Stripe and Square handle the technical, security, and regulatory aspects.

• Instant conversion: You can get paid in your local currency, avoiding crypto price swings.

• Easy customer experience: Customers simply select “crypto” at checkout and pay with their wallet, just like using Apple Pay or a card.

These integrations are lowering the barrier for businesses to accept crypto, making it as easy as flipping a switch in your POS settings.